Construction Draw vs. Completion Mortgages

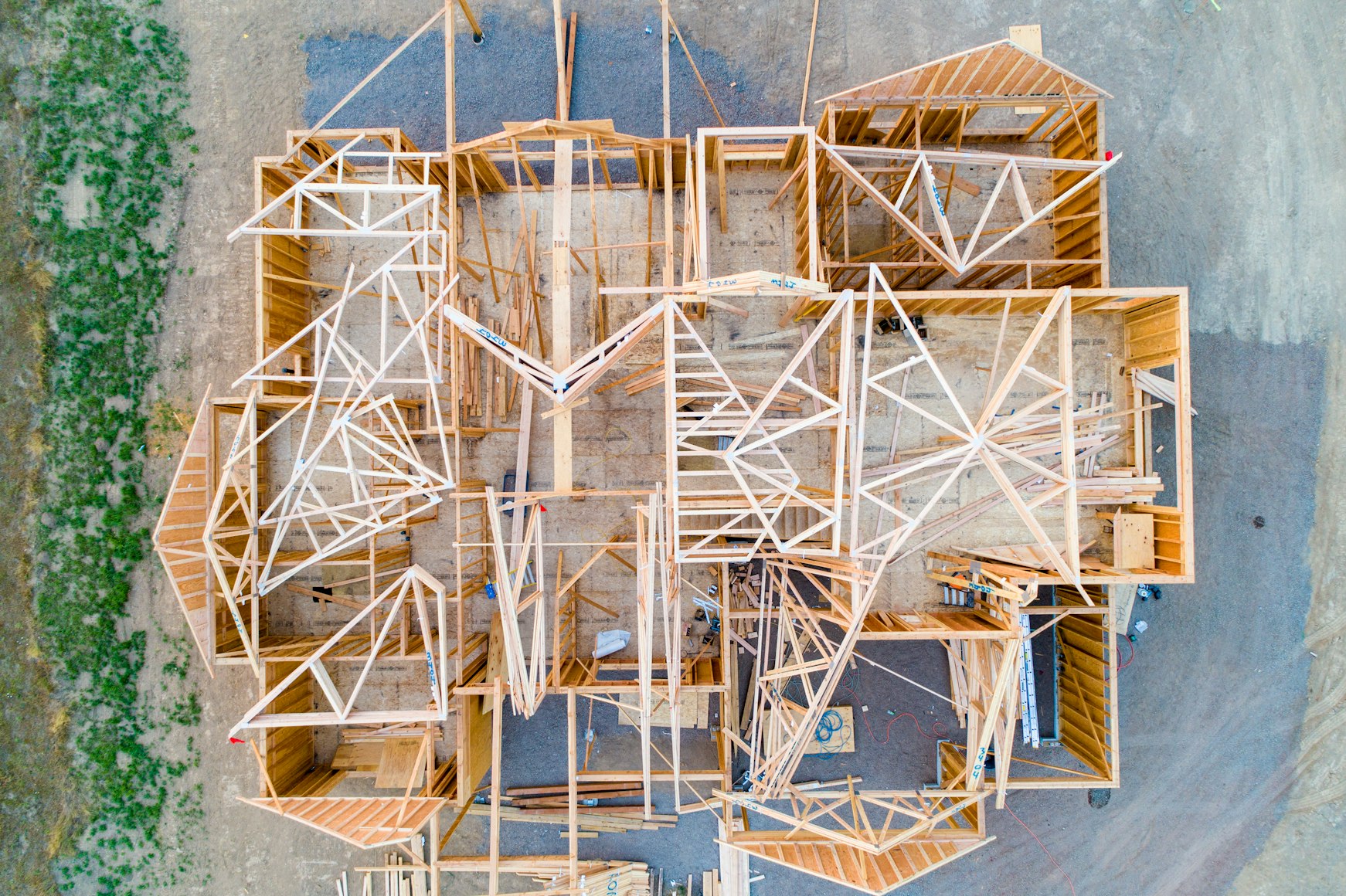

Building your own home in the scenic Kootenay region of BC, Canada is a thrilling venture that offers a unique opportunity to tailor your living space to your preferences and needs. As a dedicated mortgage broker with a keen understanding of the Kootenay area, I'm here to guide you through the intricacies of home construction financing. In this article, we'll dive into the details of two key mortgage options: construction draw financing and completion mortgages.

Construction Draw Financing: Balancing Control and Costs

Construction draw financing is a financing approach that provides homeowners with the flexibility and control to build their dream home from the ground up. Here's a closer look at how this option works:

-

Initial Approval: Before construction begins, you secure a construction draw mortgage from a financial institution, covering the land cost and initial construction plans. This is where your build plans, income and potential down payment are assessed in a full application process.

-

Draw Phases: The funds are released in stages to the builder (draws) based on construction milestones such as land, site development, lock-up, drywall, and completion.

-

Inspections and Oversight: Inspections are performed before each draw to ensure quality and adherence to the plans. This approach requires a more hands-on involvement from you, the homeowner. And likely extra costs and expenses.

-

Cost Consideration: It's important to note that the construction draw route can be costlier and demands a larger savings cushion. You make interest-only payments on the drawn amount during construction, which adds to the overall expenses.

Completion Mortgage: Streamlined Convenience with Savings Flexibility

An alternative option is the completion mortgage, which offers a streamlined approach to home construction and financing:

-

Builder Financing: Here, once we have you approved for the mortgage based on the home plans and personal application, the builder handles both the lot purchase and home construction financing.

-

Completion and Purchase: Once the builder finishes constructing the home, you purchase the completed property with your new mortgage.

-

Simplified Process: The completion mortgage approach involves fewer steps and inspections for the homeowner, providing a smoother journey for both the homeowner and the builder.

-

Savings Advantage: Unlike the construction draw option, completion mortgages require less upfront savings. You secure the mortgage upfront, and leave a deposit with the builder, but you don't start paying the mortgage costs until you move in!

Selecting the Right Path for You

Both construction draw financing and completion mortgages have their merits and considerations. The construction draw route grants you more work and involvement in the construction process but demands a larger savings buffer. On the other hand, the completion mortgage route offers convenience, a simpler process, and a lower initial savings requirement.

It's important to assess your comfort level with project management, financial readiness, and desired level of involvement in construction. As a local mortgage broker, I'm well-equipped to guide you in making an informed decision that aligns with your preferences and the specific dynamics of the Kootenay housing market. And can help reccomend builders that make your journey smooth and fun!

In conclusion, crafting your dream home in the Kootenay's is a rewarding journey filled with choices. Understanding the distinctions between construction draw financing and completion mortgages empowers you to make a well-informed decision. Whether you seek hands-on control or a smoother process with savings flexibility, the right mortgage solution awaits, enabling you to turn your vision into reality in the captivating landscape of BC, Canada.