Refinance to Invest

Use Your Home Equity to Invest in Real Estate

If you already own a home in BC, chances are you’re sitting on more potential than you realize. Refinancing can unlock the equity you’ve built and turn it into the down payment for your next investment property — without selling your current home.

I’m Andrew Ladriere from Myplace Mortgages, and I help homeowners across Cranbrook, the Kootenays, and all of BC use their equity to grow their real-estate portfolios safely and strategically.

How Refinancing to Invest Works

A refinance replaces your current mortgage with a new one — usually at up to 80% of your home’s appraised value. You can take out the difference in cash and use those funds toward:

- A down payment on a rental or vacation property

- Paying off higher-interest debt to improve cash flow

- Renovations that raise your property’s value and rental income potential

The key is structuring it properly so your new loan supports your long-term goals, not just a short-term purchase.

A Typical Refinance Example

Let’s say your home in Cranbrook is worth $600,000 and you owe $350,000. You could refinance up to 80% ($480,000) and access roughly $130,000 in usable equity.

That could cover a 20% down payment and closing costs on a $500,000 rental, while keeping your existing property. I’ll help you determine how much equity you can access — and how to keep your payments comfortable.

When Refinancing Makes Sense

Refinancing isn’t just for buying another property. It can also help when you want to:

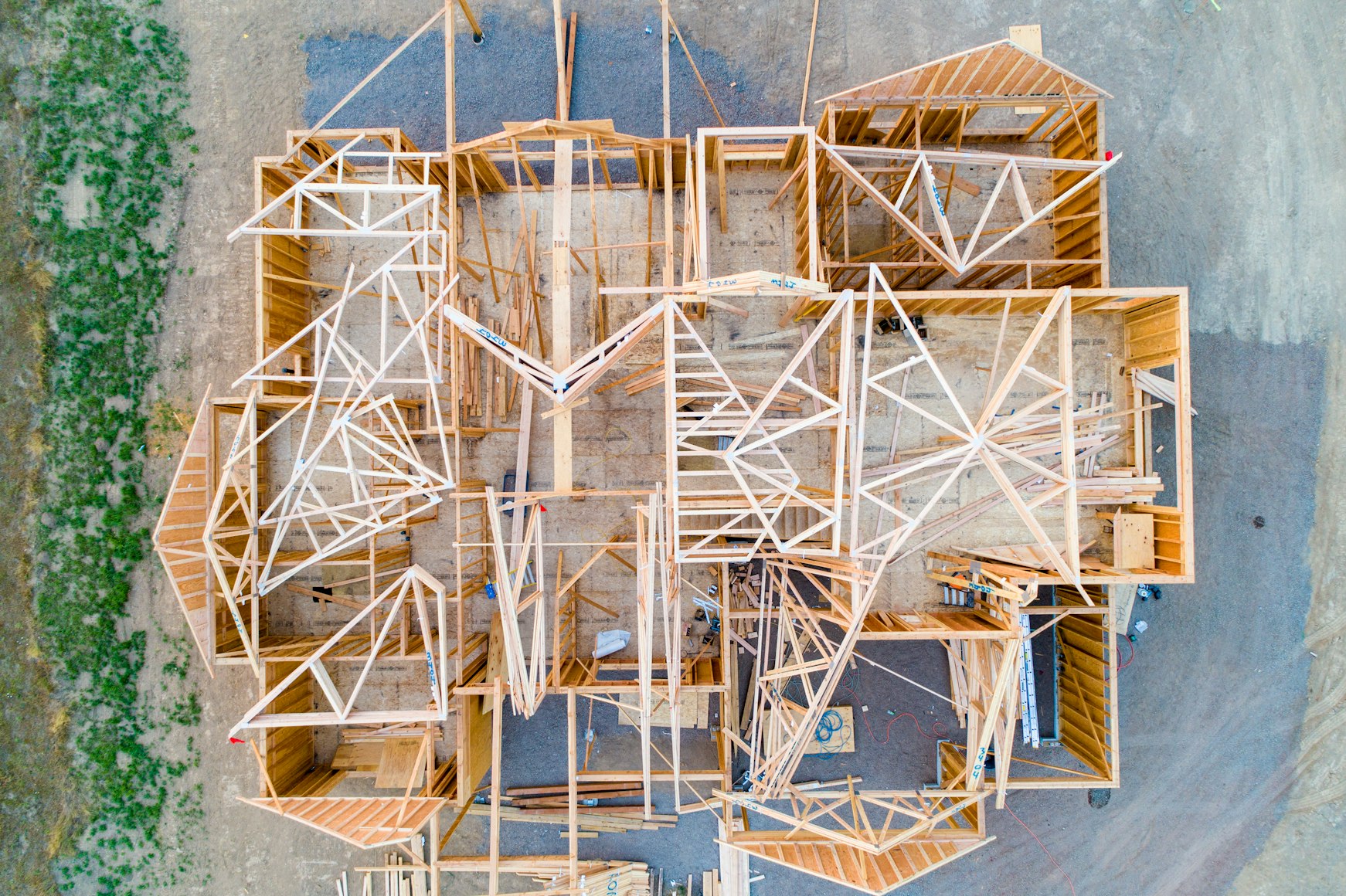

- Re-leverage equity for renovations or new builds

- Consolidate higher-interest debt into a lower mortgage rate

- Improve qualifying ratios before applying for another loan

- Free up cash flow for future investments

The right structure can position you for growth while keeping your finances balanced.

Important Things to Consider

- You’ll need a new appraisal to confirm your property’s value

- The lender will review your income, credit, and debt ratios

- You can usually refinance up to 80% loan-to-value

- Your new mortgage term and rate may differ from your current one

I’ll compare your current lender with other options to see whether switching or staying put makes the most sense.

Local Experience That Counts

Refinance rules vary between banks, credit unions, and monoline lenders. Because I work with all of them — from the big five to smaller lenders who understand local markets — I’ll make sure your refinance is approved efficiently and structured for your next step.

Whether you’re pulling equity from your Cranbrook home or a Kimberley rental, I’ll line up the financing that fits your bigger plan.

Ready to Explore Your Options?

Text or email me and I’ll show you how much equity you can access, what your new payment could look like, and the best way to turn that equity into your next property.