The Myplace Playbook // 048

Hey Everyone,

After last week’s note about using your mortgage to clean up debt, I got a bunch of texts that all sounded like:

“So… can I refinance to pay for ______?”

In most cases: yes.

When you refinance and pull equity from your home, you can generally use the funds for whatever you want (as long as it’s legal). A lender may ask the general purpose during the application, but they typically don’t require quotes, invoices, or receipts for how you spend the money. Their main focus is simple: can you qualify and comfortably make the new payment?

Here are the common ones I hear:

-

Pay off credit cards / consolidate debt: very common, and often the biggest monthly cash-flow win.

-

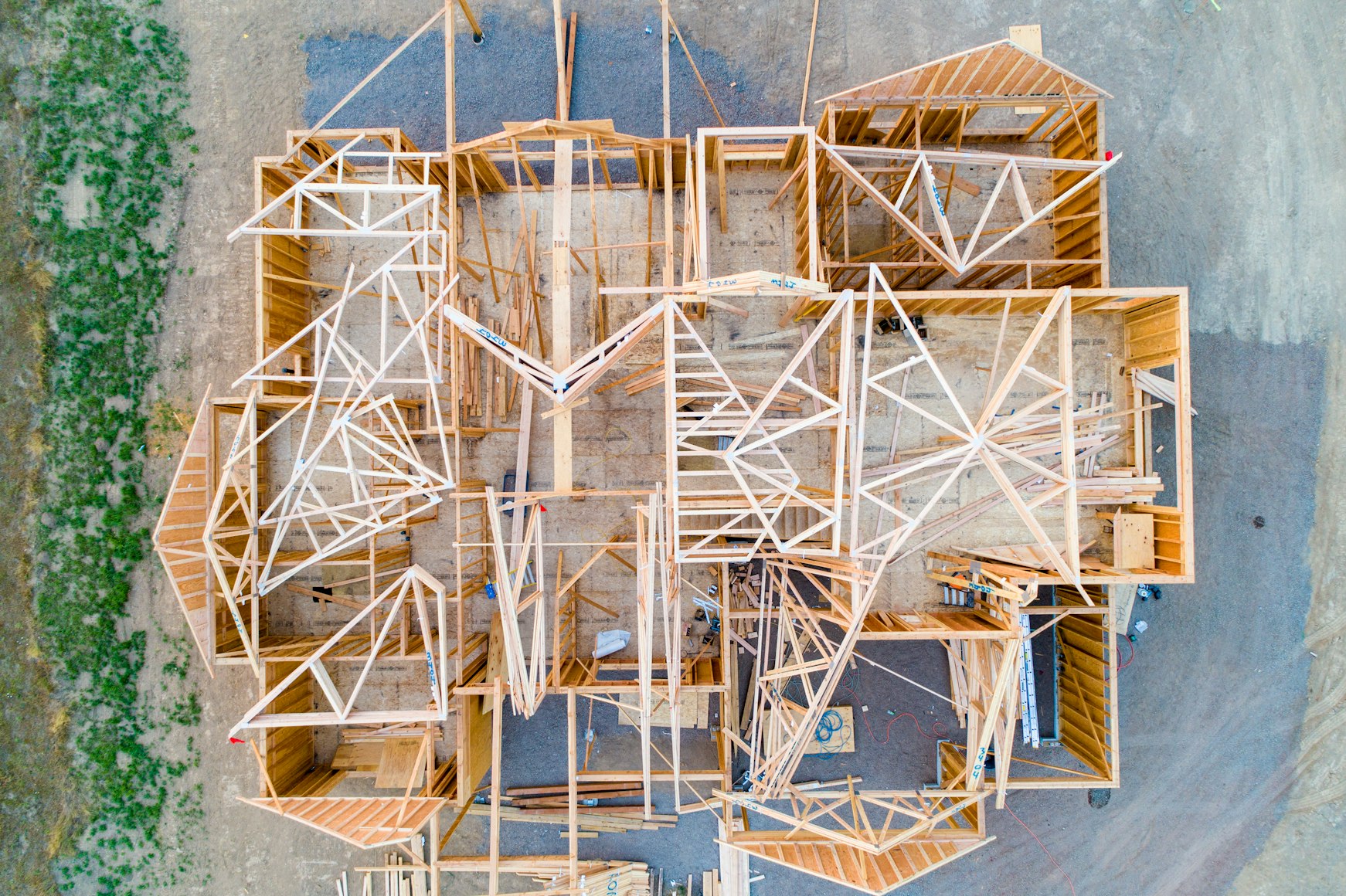

Renovations: improve the home and (sometimes) its value.

-

Wedding / major life expense: usually better than carrying it on high-interest credit.

-

Help the kids: down payment help, tuition, or getting them out of expensive debt, if it doesn’t derail your own plan.

-

Buy a car: sometimes cheaper than auto-loan rates, depending on your situation.

-

Start a business: can be a lower-rate source of capital, but it increases the stakes, plan it carefully.

-

Invest: possible, but risk varies massively, this is one we should talk through carefully.

How it works (high level)

-

We estimate your home’s value and your current mortgage balance

-

We confirm what you qualify for (in Canada, refinances are typically up to 80% of the home’s value)

-

We shop rates/terms and structure the payment

-

Funds are advanced at closing

The only real question

Does this improve your monthly situation and fit your budget?

If your mortgage payment goes up, but you’re eliminating higher-interest payments and freeing up cash flow, it can be a smart move. If the new payment strains things, we rethink the approach.

If you want me to run the numbers

Just send:

-

your current mortgage balance

-

a rough home value

-

how much you want to pull out

-

what debts/payments you’re trying to replace (and their rates, if you know them)

No judgment, no lecture, just math and options.

-Andrew

Text me, right now! 250-919-5474

I don’t say this on a whim, I’m serious, if you text me now, I can show you exactly where you stand within a few hours. No stress, no pressure, no obligation.

Just a simple text that can put you at ease.